TABLE OF CONTENTS

- What Is a Moving Average?

- Types of Moving Averages

- Characteristics of Moving Averages

- Application of Moving Averages in Technical Analysis

- Analyzing Moving Average Signals

- Why Choose a Specific Moving Average for Trading?

- Orientation Ability in a Volatile Market

- Combining Moving Averages with Other Technical Indicators

- Common Mistakes When Using Moving Averages

What Is a Moving Average?

A moving average is an essential tool in technical analysis, helping to smooth out short-term price fluctuations and identify long-term trends. This indicator calculates the average price of an asset over a specific period, thereby supporting investors in seeing the market trend more clearly.

Types of Moving Averages

Moving averages come in several types, but the most common are:

1. Simple Moving Average (SMA)

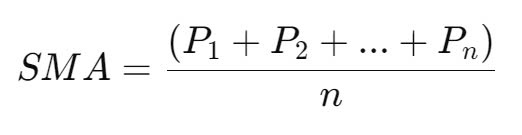

The Simple Moving Average (SMA) is calculated by taking the sum of the closing prices of an asset over a certain period and then dividing it by the number of trading sessions in that period.

SMA Formula:

Moving Average where:

- P1, P2, …, Pn are the asset’s closing prices for each trading session.

- n is the number of trading sessions in the chosen period.

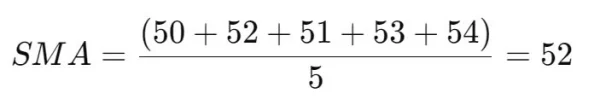

Example: To calculate the 5-day SMA for a stock, you add up the closing prices of the last 5 days and divide by 5. If the closing prices over 5 days are 50, 52, 51, 53, and 54, the SMA would be:

2. Exponential Moving Average (EMA)

The Exponential Moving Average (EMA) gives more weight to recent prices, allowing it to respond more quickly to price changes. Calculating the EMA involves a three-step process:

- Step 1: Calculate the SMA for the initial period. This value is used as the first EMA point.

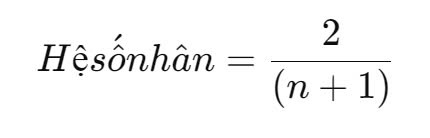

- Step 2: Calculate the smoothing factor to determine the weight applied to recent prices.

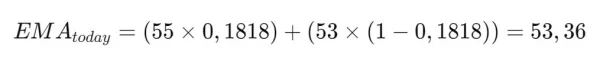

Moving Average where n is the EMA period (e.g., a 10-day EMA has a smoothing factor of 2 / (10 + 1) = 0.1818).

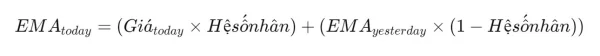

- Step 3: Calculate the EMA for each day after the initial period using the formula:

Example: For a 10-day EMA with a current price of 55 and a previous EMA of 53, and a smoothing factor of 0.1818:

The EMA will adjust quickly to the current price, helping short-term traders to capture new trends more rapidly than the SMA.

3. Linear Weighted Moving Average (LWMA)

The Linear Weighted Moving Average (LWMA) gives higher priority to recent prices in a linear manner. This moving average is effective in reducing lag but is less commonly used than SMA and EMA.

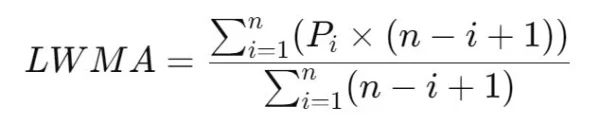

LWMA Formula:

Where:

- Pi is the price at the i-th trading session.

- n is the number of trading sessions in the period.

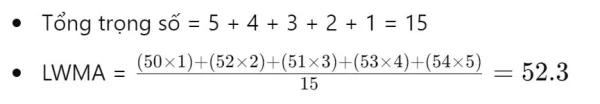

Example: To calculate the 5-day LWMA with prices over the last 5 days of 50, 52, 51, 53, and 54:

The LWMA gives the highest weight to the most recent day, making it more responsive to recent prices than the SMA.

4. Adaptive Moving Average (AMA)

The Adaptive Moving Average (AMA) is a type of moving average that adjusts automatically based on price volatility. AMA responds quickly to large price movements and slowly to minor fluctuations.

AMA Formula:

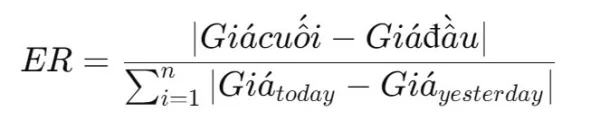

The AMA uses an adjustment factor to adapt to volatility, usually by calculating the efficiency ratio (ER) and a smoothing constant (SC) based on this ratio.

AMA Calculation Steps:

- Calculate ER: This ratio measures price change over a period relative to the total volatility over the same period.

- Calculate SC: The SC is based on ER and predetermined parameters, enabling AMA to respond to strong trends.

The AMA is more complex than other moving averages and is suitable for professional investors seeking to avoid noise in volatile markets.

The choice of moving average depends on the trading style and the desired sensitivity to price volatility. SMA is ideal for those looking for a stable overview, while EMA and LWMA are suitable for fast trades.

This overview aims to help you better understand moving averages and how to use them in technical analysis to optimize your investment strategy and enhance trading effectiveness.

Characteristics of Moving Averages

Moving averages are particularly effective at smoothing out price fluctuations and indicating the long-term market trend. However, this indicator often has a lag, especially in fast-moving markets, and may not immediately reflect minor changes.

Application of Moving Averages in Technical Analysis

Identifying Market Trends

SMA and EMA are frequently used to identify trends: when the price is above the moving average line, the market trend is generally up; conversely, when the price is below this line, the market trend is typically down.

Determining Entry and Exit Points

Both SMA and EMA are effective indicators for identifying entry and exit points. Investors often buy when the price moves above the moving average line and sell when the price crosses below it.

Example: In stock trading, if the 50-day SMA crosses above the 200-day SMA, this is considered a strong buy signal, indicating a long-term upward trend. Conversely, if the 50-day SMA crosses below the 200-day SMA, investors may consider exiting their positions.

Analyzing Moving Average Signals

Buy and Sell Signals from Crossover Events

Crossover events occur when two moving averages intersect, typically producing clear buy and sell signals. For instance, when a short-term EMA crosses above a long-term EMA, it’s a buy signal; if it crosses below, it’s a sell signal.

Moving Average Convergence and Divergence

The convergence and divergence of moving averages can forecast trend reversals. If two moving averages are coming closer together, signaling convergence, this suggests that the current trend is weakening and a reversal may be imminent.

Why Choose a Specific Moving Average for Trading?

Selecting the Right Moving Average for Your Trading Strategy

Each type of moving average aligns with different trading strategies. Short-term traders often choose EMA for its responsiveness to price changes, while long-term investors select SMA to monitor more stable trends.

Impact of Different Parameters

The time period of a moving average significantly affects its signals. Longer time periods make the indicator less sensitive to short-term fluctuations but more accurate for long-term trends.

Orientation Ability in a Volatile Market

Moving averages help reduce the impact of short-term price volatility. However, in highly volatile markets, moving average signals may lag. In this situation, investors might consider shortening the moving average period to respond more quickly to market changes.

Combining Moving Averages with Other Technical Indicators

Combining with RSI, MACD, and Bollinger Bands

Moving averages can enhance signal accuracy when combined with other indicators, such as RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands. This combination allows investors to gain a comprehensive view of market trends and reversal points.

Example: When the price crosses above the SMA and MACD provides a positive signal, this is a strong buy signal. Conversely, if the price falls below the SMA and RSI indicates overbought conditions, this could warn of an impending correction.

Common Mistakes When Using Moving Averages

Over-Reliance on Moving Averages

A common mistake is relying too heavily on moving average signals without considering other market factors. Moving averages can be affected by random fluctuations, which may produce false signals.

How to Mitigate Risk

To mitigate risk, investors should combine moving averages with other indicators and consider the overall market trend before making decisions.

DLMvn hopes this article will help you gain a better understanding of moving averages and how to use them effectively in technical analysis, optimizing your investment strategy and enhancing your trading outcomes

DLMvn > Glossary > Moving Averages – A Comprehensive Overview

Tagged Articles

Popular Moving Averages and How to Choose the Best One for Your Strategy

Discover How to Combine Moving Averages with Candlestick Patterns Effectively

Expand Your Knowledge in This Area

Glossary

What is a Stock? Basic Steps to Start Investing in Stocks

Glossary

Understanding the Federal Reserve’s Balance Sheet

Glossary

What Is Currency Manipulation? Understanding Its Nature and Impact on the Market

Glossary

Options: Essential Basics Not To Be Missed About Options Trading

Glossary

What are Fund Certificates? Key Considerations for Effective Investment

Glossary

Bollinger Bands