TABLE OF CONTENTS

- What Are Bollinger Bands?

- Formula for Constructing Bollinger Bands

- Characteristics of Bollinger Bands

- How to Use Bollinger Bands in Technical Analysis

- How to Identify Buy and Sell Signals with Bollinger Bands

- Integrating Bollinger Bands with Other Technical Tools

- Bollinger Bands and Market Volatility

- Cautions When Using Bollinger Bands

What Are Bollinger Bands?

Bollinger Bands are a technical analysis tool that helps investors assess price volatility and identify market trends. Developed by John Bollinger, this tool consists of a moving average with two standard deviation bands above and below it, assisting investors in determining when an asset might be overbought or oversold. Understanding Bollinger Bands is the first step to capturing market sentiment, allowing investors to make smarter investment decisions.

Formula for Constructing Bollinger Bands

Like many other technical indicators, Bollinger Bands can be customized using two variables, m and n. The core component of Bollinger Bands is the moving average (m), typically a 20-day Simple Moving Average (SMA). At each point, the standard deviation of a dataset of m candles (including the current candle and the previous m – 1 candles) is calculated.

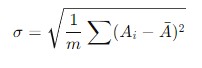

In this case:

- σ is the standard deviation

- Aᵢ represents the price data of the m candles

- A̅ is the average price of those m data points

From the moving average and the standard deviation, the upper and lower bands can be calculated as follows:

![]()

In most cases, the upper and lower bands are calculated by using 2 standard deviations (n = 2), which means that about 90% of price levels will lie within the Bollinger Bands.

Characteristics of Bollinger Bands

Bollinger Bands are a reliable tool as they are flexible and adapt to different market conditions. When the market is highly volatile, the Bollinger Bands expand to reflect major price changes. Conversely, in a stable market, the bands contract.

Example: In an uptrend, prices often touch or exceed the upper band. Statistics show that 90% of prices fluctuate within Bollinger Bands, with only 10% breaking these limits, serving as an important signal to identify investment opportunities.

How to Use Bollinger Bands in Technical Analysis

- Trend Identification – When prices approach the upper band, this indicates an uptrend. Conversely, prices touching the lower band may signal a downtrend.

- Identifying Overbought or Oversold Levels – When prices move outside the upper or lower band, the market may be overbought or oversold, indicating a potential price correction.

- Reversal Signals – Sometimes, when prices exit the Bollinger Bands in tandem with high trading volumes, this can signal a new trend.

Example: If the stock price of Company A touches the upper band during a price surge, this could indicate an ideal exit point for investors.

How to Identify Buy and Sell Signals with Bollinger Bands

Some common signals include:

- Buy signal when prices touch the lower band.

- Sell signal when prices touch the upper band.

- Breaking the Bollinger Bands may suggest that a significant price movement is about to occur.

Using Bollinger Bands makes it easier for investors to recognize buy and sell opportunities in a volatile market.

Integrating Bollinger Bands with Other Technical Tools

Bollinger Bands can be integrated with other technical indicators to increase the accuracy of trading signals and provide a more comprehensive market perspective. Technical indicators such as RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and the Stochastic Oscillator are commonly used alongside Bollinger Bands.

1. Combining Bollinger Bands with RSI

RSI is an oscillator used to measure whether an asset is overbought or oversold, oscillating from 0 to 100, with key levels at 30 and 70. Integrating Bollinger Bands and RSI confirms buy and sell signals as follows:

- Strong buy signal: When prices touch the lower band of the Bollinger Band and RSI is below 30, it may indicate that the market is oversold and an upcoming reversal is possible, prompting investors to consider a buy order.

- Strong sell signal: When prices touch the upper band of the Bollinger Band while RSI is above 70, it suggests that the market may be overbought. Investors may consider selling or taking profits to reduce risk.

Practical example: During a strong uptrend for stock XYZ, when prices touch the upper Bollinger Band and RSI reaches 75, this may be a profit-taking signal for investors. Conversely, if the stock price declines and RSI drops below 30 while touching the lower band, it signals a potential buying opportunity.

2. Combining Bollinger Bands with MACD

MACD is a trend indicator that detects price direction changes by analyzing the difference between the fast and slow moving averages. When used alongside Bollinger Bands, MACD helps confirm specific buy and sell trends:

- Buy signal: When prices touch the lower band of the Bollinger Band and MACD crosses the signal line upward, this is a potential uptrend signal, guiding investors to consider a buy order.

- Sell signal: When prices touch the upper band of the Bollinger Band while MACD crosses the signal line downward, this may indicate that the market is preparing for a downtrend, giving investors the chance to consider a sell.

Example: Suppose you are monitoring the stock of Company ABC. When MACD gives a buy signal while prices touch the lower band, this is a strong entry point. Conversely, when MACD crosses below the signal line and prices touch the upper band, it may be time to consider taking profits.

3. Combining Bollinger Bands with the Stochastic Oscillator

The Stochastic Oscillator measures overbought and oversold levels in the short term, ranging from 0 to 100, with overbought at 80 and oversold at 20. When combined with Bollinger Bands, trading signals become clearer:

- Buy signal: When prices touch the lower Bollinger Band and Stochastic Oscillator is below 20, this may be a strong buying signal with the expectation that prices will rise.

- Sell signal: When prices touch the upper Bollinger Band and Stochastic is above 80, the market may be overbought, making this an ideal point to sell or take profits.

Real-world example: For stock DEF, when Stochastic drops to 15 and prices approach the lower Bollinger Band, this indicates a potential buy entry. Conversely, when prices touch the upper band and Stochastic reaches 85, a sell signal becomes evident.

Benefits of Combining Multiple Technical Tools

Integrating multiple tools helps to:

- Increase signal reliability, as each tool provides unique insights.

- Reduce risks when a signal is confirmed by multiple indicators.

- Deepen understanding of price movements and market trends.

Challenges in combining tools: Sometimes, indicators may produce conflicting signals. For example, Bollinger Bands may suggest a buy signal, while RSI remains above 70, indicating overbought conditions. Thus, flexibility and experience are required to analyze signals comprehensively.

Bollinger Bands and Market Volatility

Under various market conditions, Bollinger Bands react differently:

- Trending market: Bollinger Bands expand when the market has a strong trend.

- Sideways market: The bands contract as the market stabilizes.

- Highly volatile market: Bands widen suddenly, signaling a potential trend change.

Statistics show that 70% of the market is sideways, making Bollinger Bands particularly useful for capturing short-term trading signals.

Cautions When Using Bollinger Bands

Bollinger Bands should not be used alone. Sometimes, signals from Bollinger Bands may be distorted by news or unexpected events. Investors should evaluate signals carefully before making decisions to minimize risks.

Example: Suppose you analyze Stock B with Bollinger Bands during a volatile market phase. When prices touch the lower band, a buy signal appears. Later, as prices rise and approach the upper band, this could be a signal to take profits.

With a sound understanding and effective application of Bollinger Bands, you can enhance your ability to predict trends and manage risks throughout your investment journey.

DLMvn > Glossary > Bollinger Bands

Tagged Articles

Trading with Bollinger Bandwidth: Identifying Accurate Entry Points

Double Bollinger Bands: Strategy for Predicting Market Volatility

Exploring the Relationship Between Bollinger Bands and MACD

Discover John Bollinger’s Bollinger Band Rules for Successful Trading

Expand Your Knowledge in This Area

Glossary

Federal Open Market Committee Meeting (FOMC Meeting)

Glossary

Purchasing Managers’ Index (PMI): A Critical Measure of Economic Health

Glossary

What Are Financial Instruments?

Glossary

Understanding Option Greeks in Stock Trading

Glossary

How Central Banks Control the Money Supply

Glossary

Treasury Inflation-Protected Securities (TIPS)