TABLE OF CONTENTS

- What is a Long Wick Candle?

- How to Identify a Long Wick Candle

- What Does the Long Wick Candle Signal in the Market?

- How to Trade with Long Wick Candles

- Advantages and Disadvantages of Long Wick Candles

- In-Depth Analysis of the Long Wick Candle

- A Contrarian View on the Long Wick Candle

- A Different Perspective on Risk Management

When following the stock market, it’s impossible not to notice candles with long wicks. These candles, also known as Long Wick Candles, are one of the essential tools that traders use to identify reversal signals in price trends. However, these signals are not always clear and easy to recognize. With years of experience in this field, DLMvn always emphasizes one important point during trading: understanding the meaning behind each candle is the key to success.

What is a Long Wick Candle?

A Long Wick Candle is a type of candle with a long wick, where the body of the candle is usually much shorter than the wick. The wick can appear either above or below the body of the candle, representing a “price rejection” by either the buyers or the sellers over a specific period. This candle is not just a price indicator, but also reflects the strength of the market at that moment.

In fact, when a Long Wick Candle appears, it can signal a significant shift in market sentiment. Specifically, if the long wick is below the body, it could indicate a strong upward move. Conversely, if the long wick is above the body, a price drop is more likely. However, like any other tool in technical analysis, using the Long Wick Candle must be part of a well-thought-out strategy.

How to Identify a Long Wick Candle

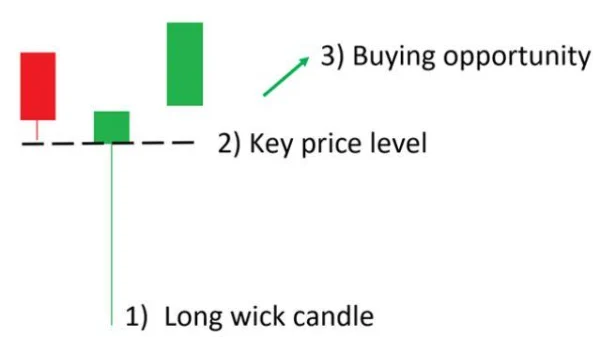

To identify a Long Wick Candle, the first thing you need to focus on is the position of the wick: if the wick is above the body, it could signal weakening buying pressure, while a wick below the body suggests that selling pressure is losing strength. Next, it’s important to use price action to identify support and resistance levels. When a Long Wick Candle appears at support or resistance levels, it often indicates a potential trend reversal, helping you make informed trading decisions.

What Does the Long Wick Candle Signal in the Market?

A typical example is the weekly chart of the NZD/JPY currency pair, where a Long Wick Candle appeared before a significant price reversal. When you see the wick below the body of the candle, it shows that sellers pushed the price significantly lower, but buyers managed to reverse the price, leading to an uptrend. On the other hand, when the wick is above the body, it indicates that buyers could not maintain control of the market, signaling a potential price decline.

Real Example of Price Action

Suppose you are monitoring the EUR/USD currency pair and see a Long Wick Candle appear after a series of bearish candles. If the wick is below the body, it could indicate a potential uptrend, as sellers could not maintain lower prices. However, DLMvn always reminds you that a Long Wick Candle does not always provide a clear signal. It is crucial to confirm this signal using other indicators like the RSI or MACD.

How to Trade with Long Wick Candles

To trade with Long Wick Candles effectively, the first thing you need to do is determine the trend. If the market is in a downtrend and you see a Long Wick Candle with the wick above the body, this could signal that the downtrend will continue. However, if the trend reverses and the pair hits resistance or Fibonacci levels, you should pay attention to the appearance of Long Wick Candles at higher price levels, as this could signal a reversal.

A specific example: If you see a Long Wick Candle in a downtrend at a resistance level, you could set a Stop Loss just above the top of the wick. This helps protect your capital and minimize risk if the price does not continue in the direction you anticipated.

Advantages and Disadvantages of Long Wick Candles

Advantages

Long Wick Candles are easy to identify and appear fairly frequently in major financial markets. They can provide clear entry signals, especially when they form at key support and resistance levels. As you can see, by simply paying attention to this candle, you can capture potential profitable trading opportunities.

Disadvantages

The main disadvantage of Long Wick Candles is that you cannot trade based on this signal alone. It is a powerful tool, but if you only use the Long Wick Candle without confirming it with other supporting signals, you can easily make mistakes in your trades. Additionally, this can make it difficult to determine the validity of the signal, as a long wick candle does not always indicate a clear reversal.

“If you trade solely based on the Long Wick Candle without combining it with other signals, you will not achieve a high win rate. DLMvn always advises traders to combine multiple factors in their trading strategy to increase the likelihood of success.”

In-Depth Analysis of the Long Wick Candle

DLMvn wants to share an important perspective: the Long Wick Candle is a great tool for identifying changes in buying and selling pressure, but to make accurate trading decisions, you need to consider the overall context.

A typical example from the U.S. stock market: When Tesla’s (TSLA) stock consistently recorded Long Wick Candles in 2020, especially after announcements about financial results and new products, experienced traders began to notice strong reversal signals. However, the appearance of long wicks also indicated concern and uncertainty in the market. Data from September 2020 shows: Tesla’s stock reached $500 and then began to show Long Wick Candles, reflecting a change in investor sentiment. The long wick below the body of the candle proved that the sellers tried to push the price down, but the buyers quickly pushed the price back up, signaling the continuation of the uptrend.

But what’s noteworthy is that later, Tesla experienced some strong corrections, with the price falling below $400 in November 2020. This is a classic example showing that the Long Wick Candle can signal a reversal, but it can also just indicate a temporary struggle within a strong trend. So, what does this mean for you as a true trader?

A Contrarian View on the Long Wick Candle

One perspective that DLMvn always wants to share with you: Never treat the Long Wick Candle as an absolute reversal signal. In some cases, although a Long Wick Candle appears, the market can still continue in the same direction, leading to unnecessary losses.

Example from the European Stock Market

In 2018, shares of Deutsche Bank (DB) repeatedly showed Long Wick Candles after financial crises. These candles made many traders believe it was a sign of a trend reversal, but the stock price continued to fall sharply. Data shows that in July and August 2018, Deutsche Bank’s stock showed Long Wick Candles at price levels below $9, yet the downtrend persisted. This highlights that the Long Wick Candle is just one signal in a broader context, and analyzing overall price action is the key to making decisions.

The Challenge of Trading with the Long Wick Candle

One of the biggest challenges when trading with the Long Wick Candle is determining whether this signal is strong enough to trigger a market reversal. Market data never gives you absolute certainty, and the Long Wick Candle is no exception. In the case of Apple (AAPL) in late 2019, when multiple Long Wick Candles appeared, many traders expected a strong recovery. However, Apple continued to exceed growth expectations in subsequent quarters, and the stock price showed no clear signs of reversal.

DLMvn has also made the mistake of overvaluing a Long Wick Candle, resulting in a unwanted loss. Therefore, DLMvn advises you to never trade based on a single signal. Identifying the trend and combining it with other indicators such as RSI, MACD, or even other candlestick patterns is crucial for creating a solid trading strategy.

A Different Perspective on Risk Management

When trading with Long Wick Candles, DLMvn always prioritizes risk management. There is nothing certain in trading, so using Stop Loss and Take Profit levels appropriately is extremely important. Long Wick Candles can help you identify key price levels, but remember that they are just a part of the overall strategy. Don’t forget to set stop loss points and protect your profits when necessary.

DLMvn also wants to emphasize that not all markets react the same way when a Long Wick Candle appears. For example, in the U.S. stock market, Long Wick Candles often have stronger significance compared to other markets like Asia, where investor sentiment can change more quickly and strongly.

DLMvn > Trading Indicators > Trade Smarter with Long Wick Candles

Expand Your Knowledge in This Area

Trading Indicators

Piercing Line and How to Use It for Market Top/Bottom Reversal in Trading

Trading Indicators

Double Bollinger Bands: Strategy for Predicting Market Volatility

Trading Indicators

Discover John Bollinger’s Bollinger Band Rules for Successful Trading

Trading Indicators

10 Candlestick Patterns Every Trader Should Know

Trading Indicators

Key Continuation Price Patterns Every Investor Should Know

Trading Indicators

Profiting from the Morning Doji Star Candlestick Pattern