The Inside Bar candlestick pattern is one of the most popular patterns in technical analysis, but it is often misunderstood in terms of its application and the signals it provides. In this article, DLMvn will take you deeper into the details of the Inside Bar pattern, how to identify it, and how to apply it in real-world trading.

What is an Inside Bar?

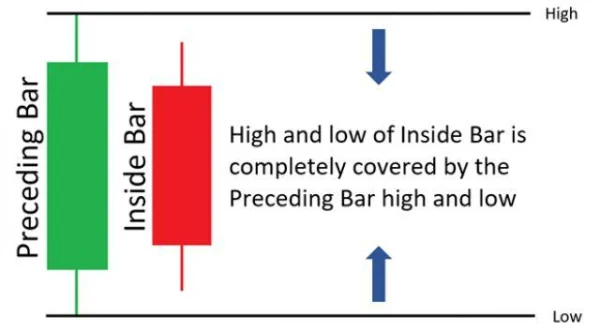

The Inside Bar candlestick pattern is one where one candlestick (the child candle) is entirely contained within the range of the previous candlestick (the mother candle). Although it may seem like a simple pattern, in reality, it holds valuable insights into market psychology. The Inside Bar represents hesitation and indecision in the short term, when the market has not yet determined a clear direction, creating opportunities for traders to catch the trend.

How to Identify an Inside Bar

To identify an Inside Bar, DLMvn recommends following these steps:

- Identify the main trend on the technical chart using price action and supporting technical indicators.

- Identify the location of the Inside Bar, where the child candle is completely within the range of the mother candle, without exceeding its high or low.

While this pattern often appears in strong trending markets, it can also signal a trend reversal, which creates an attractive opportunity for short-term trades.

Trading with the Inside Bar

The Inside Bar is a very versatile pattern, but its usage can vary depending on the perspective and trading strategy of each investor. DLMvn offers two views to help you trade effectively with the Inside Bar.

1. Trading the Inside Bar as a Continuation Pattern

Many traders consider the Inside Bar to be a trend continuation pattern. For example, when the price has been rising steadily and an Inside Bar pattern appears, they interpret it as a signal that the uptrend will continue. In this case, the Inside Bar is seen as a pause in the market, indicating a short break before continuing in the same direction.

This is often applied in strong markets with a clear trend. The goal is to make short-term trades in the direction of the previous trend continuation. However, it’s important to keep positions for no longer than 10 candles to avoid taking excessive risk when the market changes.

2. Trading the Inside Bar as a Reversal Pattern

However, the Inside Bar does not always signal a continuation of the trend. In many cases, this candlestick pattern can signal a trend reversal. When traders notice that the market no longer wants to push the price higher or lower, it may be a sign of hesitation or a change in market sentiment. Important news coming up or recent volatility may cause investors to become cautious.

In this case, the Inside Bar may signal a trend reversal, especially if a breakout occurs after the Inside Bar pattern completes. If the price breaks below the low of the mother candle, you might consider entering a sell position. Conversely, if the price breaks above the high, it could be a sign of the trend resuming upward.

Inside Bar Breakout Trading Strategy

Here is a real-life example from the EUR/GBP chart. After a strong downtrend, the Inside Bar pattern appeared, creating a narrow price range. At this point, the trader can look for a breakout, entering a position when the price breaks below the low of the mother candle.

If the price breaks below the Inside Bar’s low, it could be a signal to enter a sell position. Conversely, if the price breaks above the high of the mother candle, it signals a trend reversal, and you might enter a buy position.

Important Note: When trading with the Inside Bar, you need to set your stop-loss carefully, which could be below the low of the mother candle or use tools like Fibonacci to calculate a reasonable stop-loss level.

Advantages and Disadvantages of Using the Inside Bar

Advantages

- Easy to identify: The Inside Bar is easy to spot on the chart, allowing you to make quick trading decisions.

- Frequently appears in financial markets, especially in strong trends or after large price fluctuations.

Disadvantages

- False signals: The Inside Bar can signal either trend continuation or reversal, which can confuse inexperienced traders. Additionally, false breakouts can occur, reducing the reliability of this pattern.

As DLMvn has emphasized, while the Inside Bar can be very effective in certain situations, successful trading requires combining it with other indicators and always maintaining flexibility in your trading strategy.

In-Depth Analysis of the Inside Bar

When applying the Inside Bar candlestick pattern in stock trading, it is important to fully understand the market psychology changes that this pattern reflects. DLMvn wants to share some deeper knowledge and insights into how the Inside Bar works in different contexts.

1. Inside Bar and Market Psychology

The Inside Bar is not just a simple technical tool; it also reflects the hesitation of investors in a market that is in the process of deciding its trend. Particularly, when an Inside Bar appears after a strong rise or fall, it can indicate that investors are sitting on the sidelines, waiting for clearer signals from the market.

For example, in the U.S. stock market, when the S&P 500 has been growing strongly for a long period, and suddenly an Inside Bar pattern appears, it could signal the hesitation of investors, especially when important economic data is about to be released. Traders will wait for the market’s next move to determine whether it will continue to rise or fall.

2. Inside Bar in Growing and Congested Markets

In strong markets, especially those with clear trends, the Inside Bar can be an extremely effective tool for identifying entry points. However, in “sideways” markets—where there is no clear trend and instead, small fluctuations occur around a certain price level—the Inside Bar can generate many false signals.

For instance, in 2020, after the U.S. stock market was significantly impacted by the COVID-19 pandemic, many large stocks such as Apple and Tesla saw strong growth. At that time, Inside Bars often appeared in the charts of these stocks after brief corrections, leading many investors to believe the market would continue its upward trend. However, these Inside Bar patterns sometimes resulted in false breakouts, causing traders to make mistakes when identifying entry and exit points.

3. Inside Bar and Practical Experience

DLMvn has traded numerous times in global stock markets, and from personal experience, one of the most important factors when trading with the Inside Bar is to always combine it with other indicators and analytical tools to confirm the signal.

A specific example would be trading Amazon (AMZN) stock throughout 2021. After each strong growth phase, the Inside Bar pattern would typically appear and was seen as an opportunity for trend continuation. However, by combining it with the RSI and MACD indicators, we could more easily confirm the signal, avoiding entering a trade when the market showed signs of short-term corrections.

4. The Opposing View: Inside Bar Can Lead to False Breakouts

Although the Inside Bar is seen as a useful tool in trading, like any technical tool, it does not always provide accurate results. One of the biggest issues when using the Inside Bar is the occurrence of false breakouts—when the price breaks beyond the range of the mother candle without following the expected direction.

In this case, the Inside Bar pattern can cause traders to fall into the trap of false breakouts, leading to losses in trades with low probability of success. The occurrence of false breakouts is very common in highly volatile markets, such as during the period when the global stock market faced the COVID-19 pandemic.

False breakouts can occur during periods when there is no significant news or event to drive the price strongly in a specific direction. Therefore, traders need to take precautionary measures, such as using additional indicators or setting appropriate stop-loss levels to minimize risk.

5. A Perspective from Professional Investors

Professional investors, particularly in large investment funds, often view the Inside Bar pattern as a tool to gauge market sentiment, rather than relying solely on the pattern to make trading decisions. They typically combine the Inside Bar with the fundamental factors of the market, such as financial reports or macroeconomic data, to form a more comprehensive view.

A prime example is Microsoft (MSFT) stock at the end of 2021. After the Inside Bar appeared in an uptrend, large investment funds did not rely solely on this candlestick pattern to make decisions, but also considered external factors such as business results and the company’s growth potential. The combination of technical analysis and fundamental analysis helped them reduce risk when trading during uncertain times.

DLMvn > Trading Indicators > Inside Bar: A Powerful Candlestick Pattern for Identifying Entry Points

Expand Your Knowledge in This Area

Trading Indicators

10 Candlestick Patterns Every Trader Should Know

Trading Indicators

Trade Smarter with Long Wick Candles

Trading Indicators

Techniques for Using the Pennant Pattern in Stock Market Investing

Trading Indicators

Simple Trading Strategy with Support and Resistance

Trading Indicators

What is the Shooting Star Candlestick Pattern? Meaning and How to Identify It

Trading Indicators

How to Identify and Trade Hammer Candlesticks on Charts