If you’re seeking a comprehensive and detailed guide on dividends, this article is for you. It covers all the crucial aspects investors in the stock market need to understand, including what dividends are, how they are calculated, how to receive them, dividend payout ratios, and dividend policies. Mastering this knowledge can help investors reduce unnecessary risks and make more informed decisions in the stock market. Let’s dive in!

What is a Dividend?

A dividend is a portion of a company’s net profits that is distributed to shareholders, either in cash or other assets, after the company has fulfilled its financial obligations and reserved funds as required by law. In simpler terms, dividends are the post-tax profits shared among shareholders.

Dividends are a way for companies to distribute profits generated from their business operations after raising capital from investors. The annual shareholders’ meeting decides the dividend payout ratio and whether the dividend will be paid in cash or stock.

For instance, if a company makes a profit of $1 million after taxes and chooses to pay a 10% dividend, shareholders will receive 10% of the company’s profits, either in cash or additional shares.

Importance and Value of Dividends

Key Benefits:

- Sign of a Profitable Company: Dividends signal that a company is performing well and generating profits.

- Steady Income Stream: For shareholders, dividends provide a stable source of income.

- Opportunity for Compound Interest: In cases of declining interest rates, dividends offer the potential for compound returns if reinvested.

How Dividend Value is Determined

The value of dividends is established during the company’s annual shareholder meeting and is announced in one of two ways:

- Cash Dividends: Paid out directly based on the number of shares owned.

- Percentage of Profit: Dividends paid as a percentage of the company’s profits.

If a company decides to distribute 5% of its profits as dividends and you own 100 shares, you will receive 5% of the profit allocated for each share.

How to Receive Dividends

To receive dividends, you must hold shares of the company before the ex-dividend date. Dividends will be deposited directly into your securities account if the stock is listed. For unlisted stocks, you must contact the company to claim your dividends. If dividends are paid in the form of shares, it usually takes 30-60 days for them to appear in your account.

Important Dividend Dates:

- Ex-Dividend Date: The last day you can purchase shares and still receive dividends.

- Record Date: The date when the company finalizes its list of shareholders eligible for dividends.

If the ex-dividend date is September 10, you must buy shares on or before September 9 to qualify for the dividend payout.

Dividend Calculation

The dividend payout ratio is the percentage of net earnings distributed as dividends. It is calculated as follows:

Dividend Payout Ratio (%) = Annual Dividend per Share / Earnings per Share

Alternatively, it can also be expressed as:

Dividend Payout Ratio = 1 - Retained Earnings Ratio

This ratio shows how much of the company’s profit is returned to shareholders compared to the amount retained for reinvestment or debt repayment.

If a company pays $2 in dividends per share and earns $10 per share, the payout ratio is 20%.

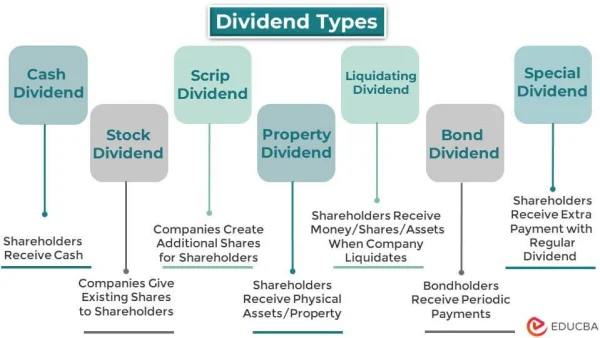

Popular Forms of Dividend Payment

1. Cash Dividends

Cash dividends are paid directly into the shareholder’s securities account based on the number of shares owned. In Vietnam, the payout is usually based on the original face value of the shares (typically 10,000 VND per share).

If you own 100 shares, and the dividend is 5%, you will receive 5% of the total face value, which is 50,000 VND.

2. Stock Dividends

In this form, the company issues additional shares to shareholders instead of cash. Stock dividends do not affect the company’s equity or the ownership ratio of the shareholders.

If the company announces a 10% stock dividend and you own 100 shares, you will receive an additional 10 shares.

Dividend Yield: What It Means and How to Calculate It

Dividend Yield Formula:

Dividend Yield (%) = Annual Dividend per Share / Share PriceA higher dividend yield indicates a higher return for shareholders.

If a stock trades at $100 and pays an annual dividend of $5, the dividend yield is 5%.

How Investors Receive Dividends

Dividends are paid within six months from the end of the annual shareholders’ meeting. The company’s board of directors determines the payout amount, ex-dividend date, and payment method 30 days before each dividend distribution.

If a company holds its annual meeting in January, dividends are usually paid by July at the latest.

Conclusion

Dividends are a vital factor to consider before investing in a company’s shares. This article has provided a comprehensive overview of dividends, how they are calculated, and how they are paid. For new investors, understanding dividends can help in making better investment decisions and maximizing returns in the stock market.

DLMvn > Glossary > What is a Dividend? Essential Knowledge About Dividends

Expand Your Knowledge in This Area

Glossary

Exploring Interest Rate Swaps: A Vital Tool in Modern Finance

Glossary

What is a Stock? Basic Steps to Start Investing in Stocks

Glossary

Every Option Trader Needs to Understand Important Terms

Glossary

Understanding Inflation: A Comprehensive Overview

Glossary

Understanding Money Supply

Glossary

What is the Stock Market? A Beginner’s Guide to Understanding Securities