What Is The Stochastic Oscillator?

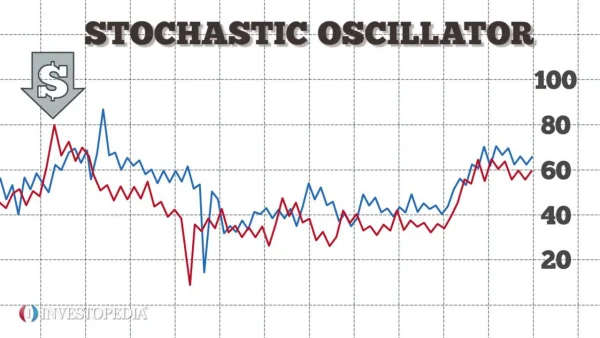

The Stochastic Oscillator is a technical analysis tool used to predict market trends by comparing an asset’s closing price with its price range over a set period. Developed in the late 1950s by George Lane, this indicator is commonly used to identify overbought and oversold levels, thus anticipating possible market reversals.

DLMvn believes that this indicator is straightforward and valuable for investors, especially in sideways markets, helping to filter out false signals and improve decision-making accuracy.

Formula For %K

The formula for %K in the Stochastic Oscillator is based on the ratio between the current price level and the price range over a specific period. Specifically, the formula for %K is:

Stochastic Oscillator

Where:

- C is the current price

- L is the lowest price over the last x periods

- H is the highest price over the same period

The %K line is highly sensitive to price fluctuations, so it is often smoothed using a moving average (MA) to reduce noise. Once smoothed, this line becomes the final %K line on the chart. Additionally, the %D line is the MA(z) of %K, providing a smoother signal for making trading decisions.

Characteristics Of The Stochastic Oscillator

The Stochastic Oscillator has several important characteristics that help identify market trends. This indicator ranges from 0 to 100, with two key levels: 80 (overbought) and 20 (oversold). When the indicator rises above 80, the market might be overbought; when it drops below 20, the market might be oversold.

Case study: According to a report by ABC Research, the Stochastic Oscillator is effectively applied during sideways markets to filter out false signals and enhance the accuracy of investment decisions.

Divergence And Reversal Signals

Divergence between price and the Stochastic Oscillator is a strong signal of potential market reversal. A bullish divergence (price declines while Stochastic rises) often signals a potential price increase, while a bearish divergence (price rises while Stochastic falls) may indicate a downward trend.

Practical example: During a technology sector stock analysis, when Microsoft stock continued to rise but Stochastic started to fall, it signaled a possible price correction. This is an important signal investors should monitor closely.

How To Set Optimal Parameters For The Stochastic Oscillator

To make the Stochastic Oscillator work effectively, it is essential to set the x, y, z parameters based on the chosen timeframe and trading style:

- Short-term trading: Use parameters (x=5, y=3, z=3) to reflect quick price changes on daily charts.

- Medium-term trading: Use parameters (x=14, y=3, z=3), which are commonly applied for periods ranging from weeks to months.

- Long-term trading: Use larger parameters (x=21, y=3, z=3) to avoid false signals in long-term trends.

Suggestion from DLMvn: Investors should adjust the parameters based on market stability. For highly volatile markets, shorter parameters allow quicker responses to changes.

How To Use Stochastic In Combination With Other Indicators

The Stochastic Oscillator is powerful on its own, but combining it with other technical indicators can increase signal accuracy and filter out noise. Some popular indicators to pair with Stochastic include the Moving Average (MA) and the Relative Strength Index (RSI). Here’s how to combine them effectively in technical analysis.

1. Combining Stochastic With Moving Averages (MA)

The Moving Average (MA) is a popular trend indicator that helps define the main market trend and smooth out short-term price fluctuations. When combined with Stochastic, MA can help confirm or negate buy/sell signals given by Stochastic.

How to use:

-

Trend confirmation: If Stochastic moves into oversold territory and starts to turn up, but a longer-term MA (e.g., MA 50 or MA 200) still shows a downtrend, investors may want to remain cautious as the downtrend may still dominate. Conversely, if the MA indicates an uptrend, this could reinforce a stronger buy signal.

-

Entry points: For optimal entry points, investors can combine Stochastic with a short-term MA (e.g., MA 10). When Stochastic is overbought and the price crosses below the short-term MA, this could indicate an imminent price decline, making it suitable for selling.

Specific example: In the case of Vinamilk (VNM) stock, if Stochastic is in the overbought zone and the 50-day MA begins to slope downwards, this could warn of a potential price drop. Conversely, if Stochastic rises from oversold territory and the stock price crosses above a short-term MA, this could support a buy decision.

2. Combining Stochastic With The RSI

The Relative Strength Index (RSI) measures the speed and change of price movements, identifying overbought and oversold levels similar to Stochastic. However, combining both can confirm signals more reliably or filter out noisy signals.

How to use:

-

Overbought/Oversold confirmation: When both Stochastic and RSI are in the overbought zone (Stochastic above 80, RSI above 70), a correction is likely. Conversely, when both are in the oversold zone (Stochastic below 20, RSI below 30), this is a good indication for buying.

-

Simultaneous divergence: If both Stochastic and RSI show divergence with the price (e.g., price rises while both Stochastic and RSI fall), this is a strong signal that the trend may reverse.

Specific example: Suppose FPT stock is rising, but both Stochastic and RSI are in the overbought zone and starting to decline. Investors might consider selling as a price correction is likely. However, if both indicators are in the oversold zone and signal an upward move, this could present a good buying opportunity.

3. Combining Stochastic With Bollinger Bands

Bollinger Bands help define price volatility and indicate when the price may exceed its typical range. When combined with Stochastic, Bollinger Bands can help identify potential reversal points.

How to use:

-

Buy at the lower band: When the price hits the lower Bollinger Band and Stochastic is in the oversold zone, this could signal an upward reversal. Investors might consider buying as Stochastic starts to turn up.

-

Sell at the upper band: When the price touches the upper Bollinger Band and Stochastic is overbought, a price correction is likely. If Stochastic moves down from above 80, this could be a good time to sell.

Specific example: For Hoa Phat (HPG) stock, if the price touches the lower Bollinger Band and Stochastic begins to rise from the oversold zone, investors might view this as a buy signal. This approach is especially effective in range-bound markets.

4. Combining Stochastic With MACD (Moving Average Convergence Divergence)

MACD is a momentum indicator often used to identify trends and potential reversal points. Combining Stochastic with MACD can add confidence to buy and sell signals.

How to use:

-

Trend confirmation with MACD: When Stochastic gives a buy signal (e.g., turning up from the oversold zone) and MACD shows a bullish crossover (the MACD line crossing above the signal line), this is a strong buy signal.

-

Exit point: When Stochastic is in the overbought zone and MACD indicates a bearish crossover (MACD line crossing below the signal line), this is a warning that prices may fall, making it a good time to consider selling.

Specific example: For Mobile World (MWG) stock, if Stochastic signals oversold and MACD shows a bullish crossover, this may be a good buying signal. Conversely, if Stochastic is in the overbought zone and MACD shows a bearish crossover, it may be time to exercise caution or consider selling.

DLMvn hopes that combining Stochastic with indicators such as MA, RSI, Bollinger Bands, and MACD provides a more comprehensive view of market trends and price movements, allowing you to make precise and effective investment decisions.

DLMvn > Glossary > Stochastic Oscillator: An Effective Tool For Forecasting Market Trends

Expand Your Knowledge in This Area

Glossary

Central Bank: The Power Regulating The Economy

Glossary

Exchange-Traded Funds (ETFs): An Overview

Glossary

Why Is Economic Growth Important?

Glossary

Bollinger Bands

Glossary

Options: Essential Basics Not To Be Missed About Options Trading

Glossary

What Is Currency Manipulation? Understanding Its Nature and Impact on the Market