When it comes to technical analysis in the stock market, we cannot overlook the triangle pattern, one of the most common and recognizable chart patterns. Throughout DLMvn’s investment career, I have witnessed numerous traders fall into the “false breakout” traps when attempting to capitalize on these patterns. However, if understood correctly and applied with finesse, the triangle pattern can not only help identify trends but also present significant profit opportunities.

What is the Triangle Pattern?

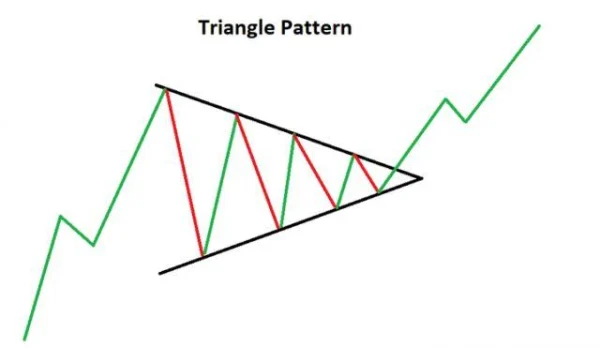

The triangle pattern is a consolidation pattern, frequently appearing in the middle of a trend and often signaling the continuation of that trend. This pattern forms when price moves sideways within a narrow range, and you will see two converging trendlines. These patterns reflect the battle between buyers and sellers, and when the price breaks through one of the triangle’s sides, a strong trend may emerge. The issue here is that not all triangle patterns provide the same signals, so you must learn to differentiate between the types and choose the appropriate trading strategy.

Common Triangle Patterns

DLMvn has witnessed many triangle patterns appear on global stock charts, and it can be said that these patterns have three main variations: Symmetrical Triangle, Ascending Triangle, and Descending Triangle. Each type has its own characteristics and is used in different trading strategies.

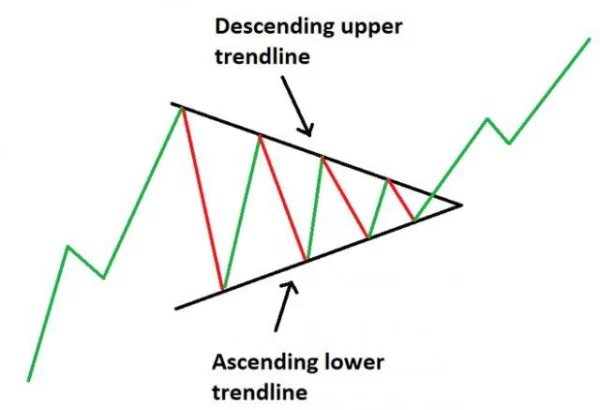

1. Symmetrical Triangle

The symmetrical triangle, as its name suggests, forms when one upward trendline and one downward trendline converge. This is a neutral pattern, not favoring either the buyers or the sellers. However, despite being neutral, this pattern still indicates the continuation of the current trend.

One of the things DLMvn often sees is that traders tend to overlook imperfect triangle patterns. This is a serious mistake. A perfect symmetrical triangle pattern is actually very rare. Traders should not just look for a “perfect” pattern but should instead know how to feel the market and apply strategies based on price action.

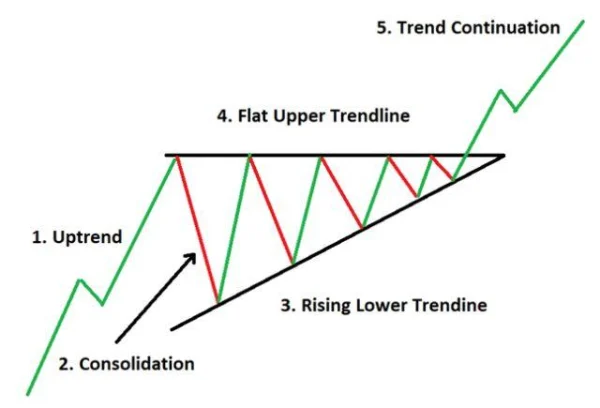

2. Ascending Triangle Pattern

The ascending triangle pattern features an upward trendline forming the lower side of the triangle, while the upper side is horizontal. This is a strong pattern signaling that the buyers are in control. This pattern often appears in an uptrend, and when the price breaks through the upper side, traders can enter a long position.

One important aspect when trading with the ascending triangle is to correctly identify the pattern’s formation location. DLMvn has seen many traders miss out on opportunities by neglecting this factor. If an ascending triangle forms at the bottom of a downtrend, it could signal a trend reversal, providing an opportunity to open a long position.

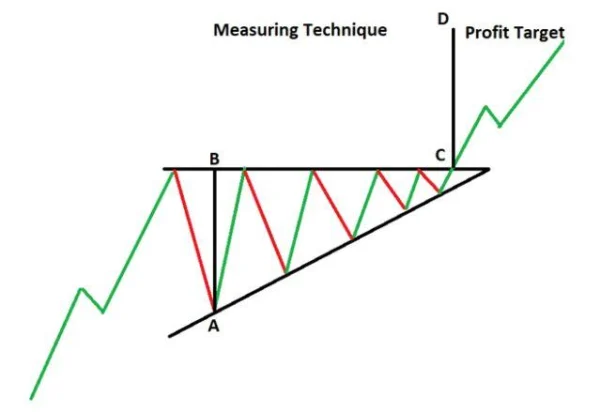

When trading with the ascending triangle, you should calculate the distance between the top and bottom sides of the triangle. This distance will serve as the price target after the breakout from the upper side. This is a simple yet highly effective strategy for determining the take-profit level.

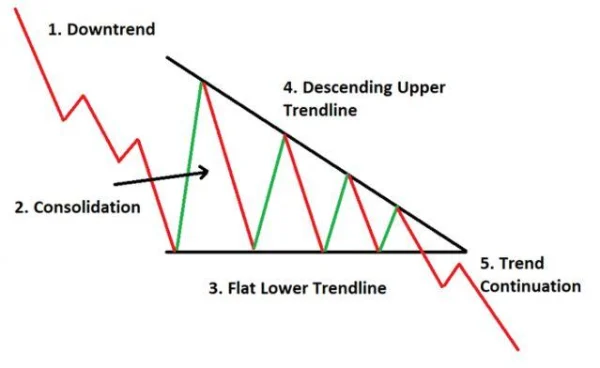

3. Descending Triangle

The descending triangle is a common pattern when the sellers are in control. The upper side of the pattern forms a downward trendline, while the lower side is horizontal, acting as support. This pattern shows the weakening of the buyers, and when the price breaks through the lower side, the downtrend will continue.

Descending triangle patterns often appear in a downtrend, and you can open a short position when the price breaks the support line. However, as with any pattern, identifying the right timing and managing risk are key to success.

Similar to the ascending triangle, traders should measure the distance from the highest point of the triangle to the lower side, and this distance will be applied to determine the take-profit level when the price breaks the lower side. To trade effectively with the descending triangle, it is important to clearly identify the trend before the pattern appears.

Pros and Cons of Triangle Patterns

Pros

Triangle patterns are easy to recognize and have clear price targets for take-profit. This helps traders make trading decisions without worrying too much about the ambiguity of the signals.

Cons

However, triangle patterns are not without drawbacks. One of the biggest issues is the potential for “false breakouts,” where the price breaks through one side of the triangle but then reverses and does not continue in the predicted trend. Additionally, this pattern can sometimes persist for a long time without any clear breakout, causing traders to fall into false signals.

Important Notes When Trading with Triangle Patterns

When trading with triangle patterns, DLMvn would like to emphasize some important points:

- Identify the dominant trend of the market before the triangle pattern forms. This helps you make the right trading decisions.

- Use trendlines to accurately identify the triangle pattern. Never underestimate the importance of trendlines in helping you spot the pattern.

- Measure and determine the take-profit point: This is an essential step when trading with triangle patterns. Applying this method helps you maximize profit.

- Risk management: Always remember that no pattern is perfect. Therefore, adhering to risk management strategies will help you minimize losses when encountering a “false breakout.”

The Challenges of Trading with Triangle Patterns

One of the major issues that traders often face when using triangle patterns is false breakout. This occurs when the price breaks through one side of the triangle but then reverses and does not continue in the expected direction. This happens not because the triangle pattern is wrong, but because many short-term factors influence the market that are beyond your control, such as unexpected economic data, political decisions, or shifts in market sentiment.

Specific Example of a False Breakout in the US Market

Let’s take Tesla (TSLA) stock in 2021 as an example. An ascending triangle pattern formed as the stock consolidated after a strong growth phase. Traders expected a strong breakout above the resistance level. However, after the price broke higher, the market did not continue the trend and reversed, with the stock experiencing a sharp decline the following month. This is a clear example of a false breakout, which in this case could be attributed to a shift in investor sentiment and negative news regarding Tesla’s production.

Triangle Patterns Do Not Always Guarantee Success

DLMvn also wants to share a contrarian view on triangle patterns. While these patterns appear frequently in the market, they do not always provide reliable signals. An important factor that many traders overlook is signal confirmation. A triangle pattern only offers the potential to predict a trend based on historical analysis, but it cannot guarantee that the trend will continue.

1. Observe the Broader Market

A major issue when trading with triangle patterns is that traders often focus solely on the pattern on the chart without considering macroeconomic factors. For example, during the 2008 financial crisis, although many stocks formed triangle patterns, the broader market impact and political and economic factors completely weakened the signals from these patterns. In that case, the global stock market was heavily influenced by unpredictable factors that could not be forecasted using purely technical analysis.

2. Technical Analysis Is Just One Part

Some novice traders may become overly reliant on technical analysis without truly understanding that triangle patterns are only one part of an overall trading strategy. To trade successfully, you need to combine technical analysis with tight risk management, fundamental analysis, and continuous monitoring of market sentiment. Without this, trading with triangle patterns will only lead you to become one of the many who make common mistakes in the financial market.

Triangle Patterns in the Global Market

An interesting point that DLMvn has noticed is that although triangle patterns appear frequently in major stock markets, the accuracy of the breakout signals cannot always be predicted. For example, in 2020, only 60% of triangle patterns with breakout signals actually resulted in sustained moves. This shows that this pattern only works under certain market conditions, and traders need to use other tools to confirm the signals.

One of the key theories that DLMvn applies when analyzing triangle patterns is Dow Theory, which states that “the market is always in trend.” Triangle patterns not only signal the continuation of the current trend but also reflect consolidation during the “sideways” phase. The market will always test key price levels before deciding to break into a new trend. This requires you not just to read the charts, but also to feel the pulse of the market.

DLMvn > Trading Indicators > Triangle Patterns: The Most Common Patterns Appearing on Charts

Expand Your Knowledge in This Area

Trading Indicators

Engulfing Pattern: A Reversal Signal in Technical Analysis

Trading Indicators

How to Identify Rectangle Patterns in Trading

Trading Indicators

4 Ways to Leverage Support and Resistance for Optimal Trading

Trading Indicators

What Are Lagging Indicators? A Comprehensive Guide And Practical Applications

Trading Indicators

Key Continuation Price Patterns Every Investor Should Know

Trading Indicators

Head And Shoulders Pattern: How To Identify Reversal Signals