TABLE OF CONTENTS

- What Is the Bullish Engulfing Candlestick?

- The Bearish Engulfing Pattern and Key Differences

- Specific Analysis in the Stock Market

- Further Analysis of Bearish Engulfing in the Stock Market

- In-Depth Analysis of Investor Psychology Behind Bullish and Bearish Engulfing

- Notable Examples in International Stock Markets

- Challenges in Trading with Engulfing Patterns

- Smarter Trading Strategies with Engulfing Patterns

The Bullish Engulfing and Bearish Engulfing candlestick patterns are two commonly used tools for identifying trend reversals in technical analysis. From DLMvn’s perspective, these patterns are not just market signals but also convey profound insights into investor psychology.

What Is the Bullish Engulfing Candlestick?

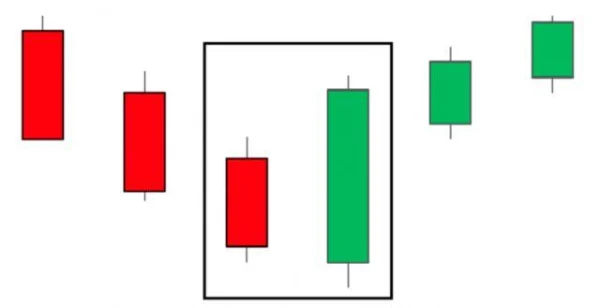

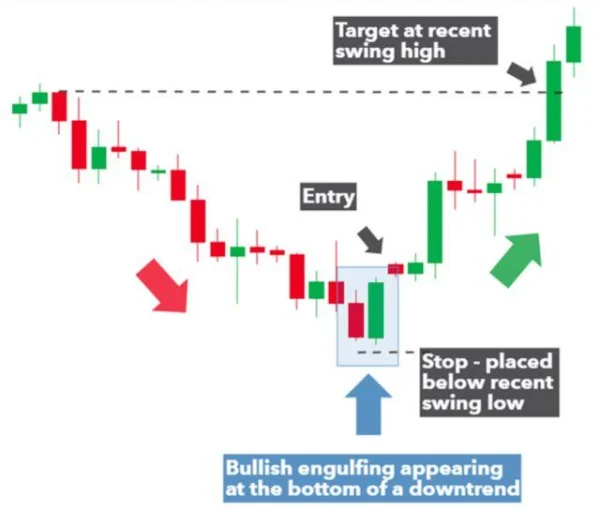

The Bullish Engulfing pattern appears at the bottom of a downtrend, signaling dominant buying pressure. This pattern is characterized by a large green candle that fully engulfs the body of the preceding red candle, as shown in the chart below.

1. Characteristics of the Bullish Engulfing Pattern

- The second candle (green) “engulfs” the entire body of the previous red candle (ignoring the wicks).

- Typically appears at key support levels or significant lows in a downtrend.

- The signal becomes stronger if the red candle is a Doji or if the green candle closes above the high of the pattern.

2. The Significance of the Bullish Engulfing Pattern

- Marks the weakening of selling pressure, indicating a potential bullish reversal.

- Appears at critical levels, such as support zones or previously rejected price areas.

3. Advantages of Trading with Bullish Engulfing

- Easy to identify, even for beginners in the market.

- Clear reversal signal, offering attractive entry opportunities.

The Bearish Engulfing Pattern and Key Differences

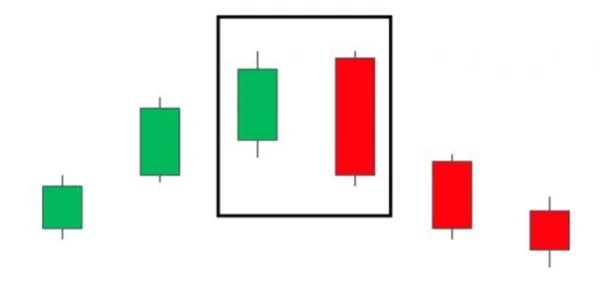

While the Bullish Engulfing signals a bullish reversal, the Bearish Engulfing pattern conveys the opposite: predicting a bearish reversal. This pattern appears at the top of an uptrend, reflecting strong selling pressure.

| Characteristic | Bullish Engulfing | Bearish Engulfing |

|---|---|---|

| Candlestick | A green candle “engulfs” the previous red candle | A red candle “engulfs” the previous green candle |

| Appearance | At the end of a downtrend | At the end of an uptrend |

| Signal | Bullish reversal | Bearish reversal |

Specific Analysis in the Stock Market

1. Example of Bullish Engulfing on the S&P 500 Index

During the financial crisis of 2008, the S&P 500 Index formed a significant Bullish Engulfing pattern at the bottom of a downtrend. A strong green candle appeared at the end of November, marking the index’s lowest point in the cycle. Subsequently, the market steadily climbed throughout 2009, demonstrating the power of this pattern.

2. Trading with Support Signals

To maximize effectiveness when using the Bullish Engulfing pattern, combine it with indicators like RSI or MACD. For instance, if RSI is in the oversold region and a Bullish Engulfing forms near a support level, the likelihood of success increases.

An important tip: always set a stop loss just below the pattern’s lowest point and adjust according to a suitable risk/reward ratio.

3. Challenges in Applying the Pattern

- Not all Bullish or Bearish Engulfing patterns lead to clear reversals.

- When trading in highly volatile markets, signals can become unreliable. Approximately 30-40% of Engulfing patterns fail if not confirmed by other factors.

Further Analysis of Bearish Engulfing in the Stock Market

Bearish Engulfing is also a significant signal, often used to identify short-selling opportunities. During the strong growth phase of the Nasdaq Composite index in 2021, the Bearish Engulfing pattern emerged at its peak, right before the market began a sharp correction in early 2022.

A small tip when trading with Bearish Engulfing: monitor trading volume. If the volume significantly increases on the day the pattern forms, the bearish signal becomes more reliable.

Using Bullish and Bearish Engulfing patterns is not just about recognizing trends but also provides a strategic approach to market participation.

In-Depth Analysis of Investor Psychology Behind Bullish and Bearish Engulfing

Both Bullish and Bearish Engulfing reflect critical psychological shifts in the market. When a Bullish Engulfing appears, it signals a transfer of control from sellers to buyers. Similarly, Bearish Engulfing indicates the weakening of buyers and the strong presence of sellers.

Contrasting Views on the Effectiveness of These Patterns

Not all investors agree that Engulfing patterns provide reliable signals. Some experts argue that in modern markets dominated by algorithmic trading, candlestick patterns may become less effective. A study conducted by New York University in 2020 revealed that over 50% of Bullish Engulfing and Bearish Engulfing patterns fail to result in significant reversals without additional confirmation factors like trading volume or macroeconomic context.

Notable Examples in International Stock Markets

1. Bullish Engulfing and Apple Stock (AAPL)

At the end of 2018, as Apple’s stock price dropped sharply due to concerns about iPhone sales, a Bullish Engulfing pattern appeared near the $140 support level. This coincided with positive news about revenue growth from services, and the stock price climbed above $200 within six months. This example illustrates how the pattern can reflect investor confidence in a recovery.

2. Bearish Engulfing and the European Market

During the European debt crisis in 2011, Germany’s DAX index displayed a Bearish Engulfing pattern right before declining over 20% within three months. This highlights that the pattern’s signals can be highly effective in volatile markets influenced by macroeconomic factors.

Challenges in Trading with Engulfing Patterns

- Highly Context-Dependent: An Engulfing pattern that forms in an insignificant price area may not provide valuable predictions.

- False Signals: In low-liquidity markets, Engulfing patterns can result from false movements caused by large investors’ manipulations.

- Need for Additional Confirmation: Some traders recommend supplementing with technical indicators like trading volume, RSI, or MACD to enhance signal accuracy.

Smarter Trading Strategies with Engulfing Patterns

- Use Multiple Timeframes: For example, if you spot a Bullish Engulfing on the daily chart, check the weekly chart to confirm the larger trend.

- Focus on Key Support and Resistance Levels: Engulfing patterns work best when they appear at meaningful price levels, such as critical Fibonacci retracements or pivot points.

Do not rely solely on one pattern to make trading decisions. Instead, consider it part of a comprehensive strategy that combines technical analysis, economic context, and market psychology.

Bullish and Bearish Engulfing patterns, while offering significant potential, require careful observation and experience to maximize their value. Always remember, smart trading is not just about recognizing patterns but also about applying them wisely in specific market situations.

DLMvn > Trading Indicators > Smart Trading With Bullish and Bearish Engulfing Patterns

Expand Your Knowledge in This Area

Trading Indicators

10 Candlestick Patterns Every Trader Should Know

Trading Indicators

Mastering the Morning Star Candlestick to Conquer the Market

Trading Indicators

What Are Lagging Indicators? A Comprehensive Guide And Practical Applications

Trading Indicators

Techniques for Using the Pennant Pattern in Stock Market Investing

Trading Indicators

Trade Smarter with Long Wick Candles

Trading Indicators

What Is Price Action? A Basic Guide to Understanding This Method