What Is QE?

Quantitative Easing (QE) is an unconventional monetary policy tool used when interest rates approach 0% but the economy still requires stimulation. Through QE, central banks purchase long-term financial assets, such as government bonds, from the open market to increase liquidity and promote credit, spending, and investment.

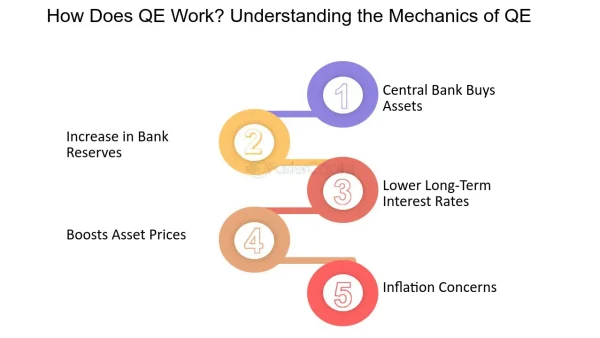

How Does QE Work?

QE operates through the monetary transmission mechanism, influencing the economy via key channels:

1. Interest Rates

When central banks purchase bonds, bond prices rise, causing yields to fall. This results in lower borrowing costs, encouraging businesses and individuals to take loans for investments or expenditures.

2. Credit

Increased liquidity within the banking system allows financial institutions to lend more easily, thereby stimulating business activities.

3. Investor Expectations

QE signals that the central bank is committed to supporting the economy, building investor confidence and encouraging investments in riskier assets like stocks.

QE’s Impact On The Stock And Real Estate Markets

1. Stock Market

QE boosts cash flow into the stock market as investors seek higher yields compared to safer assets like bonds. This often drives significant increases in stock prices.

Example: Between 2009 and 2014, during the Federal Reserve’s QE implementation, the S&P 500 index rose by over 200%, reflecting robust stock market growth.

2. Real Estate Market

Low interest rates resulting from QE increase borrowing affordability for home purchases, driving up property prices. However, this also carries the risk of asset bubbles if real estate prices surpass their intrinsic value.

Global Examples Of QE

1. Japan (1997 Crisis)

The Bank of Japan (BoJ) was among the first to use QE to combat deflation following the 1997 financial crisis. However, QE’s effectiveness in Japan was limited due to the country’s prolonged negative growth.

2. Switzerland (2008 Financial Crisis)

The Swiss National Bank (SNB) deployed QE to stabilize the Swiss franc and reduced interest rates to negative levels, stimulating consumption and exports.

3. United Kingdom (Post-Brexit QE)

After Brexit, the Bank of England (BoE) implemented QE to stabilize the economy amid political and economic uncertainty. The BoE purchased over £435 billion in financial assets, reducing borrowing costs.

Comparing QE With Other Policy Tools

- Lowering interest rates: Acts more quickly but becomes ineffective when rates hit the lower bound.

- Purchasing short-term bonds: Impacts short-term interest rates, whereas QE targets long-term rates and system-wide liquidity.

QE is often employed when traditional tools are no longer effective.

QE’s Impact On Exchange Rates

QE often weakens the domestic currency due to increased money supply. This stimulates exports, as domestic goods become more competitive internationally, but it can also raise import costs, pressuring the trade balance.

Example: After the European Central Bank (ECB) launched QE in 2015, the euro depreciated by over 20% against the U.S. dollar, significantly boosting exports within the EU.

QE’s Role In Tackling The COVID-19 Pandemic

During the COVID-19 pandemic, central banks worldwide expanded QE to support the economy. The Fed introduced an unprecedented QE program, purchasing over $120 billion in bonds monthly, lowering borrowing costs, and stabilizing financial markets.

Possible Scenarios When QE Ends

When central banks gradually withdraw QE, potential outcomes include:

- Monetary tightening: Interest rates rise again, reducing spending and investment.

- Financial market volatility: Investors may shift from stocks to bonds, causing stock prices to drop.

Example: When the Fed ended QE in 2014, U.S. Treasury yields rose from 2.5% to 3%, creating significant pressure on the stock market.

Discussion On QE’s Long-Term Effects

Some argue that QE fosters short-term economic recovery but may lead to unsustainable growth and long-term inflation. According to a World Bank study, countries implementing prolonged QE often face risks of rising public debt and financial instability.

This article provides an in-depth understanding of Quantitative Easing (QE), from its mechanism and effects on financial markets to its challenges and long-term implications, helping you grasp this critical monetary policy tool’s role in modern economies

DLMvn > Glossary > Quantitative Easing (QE) and What You Need to Know

Expand Your Knowledge in This Area

Glossary

Bollinger Bands

Glossary

Understanding Money Supply

Glossary

Electronic Communication Network (ECN): An Effective Connection Tool for Investors

Glossary

Understanding Money Demand and Interest Rates

Glossary

Options: Essential Basics Not To Be Missed About Options Trading

Glossary

Reflation Trade – Trading Based on Inflation Expectations